Home

TradingSystems

Information, charts and tools for investors

|

|

|

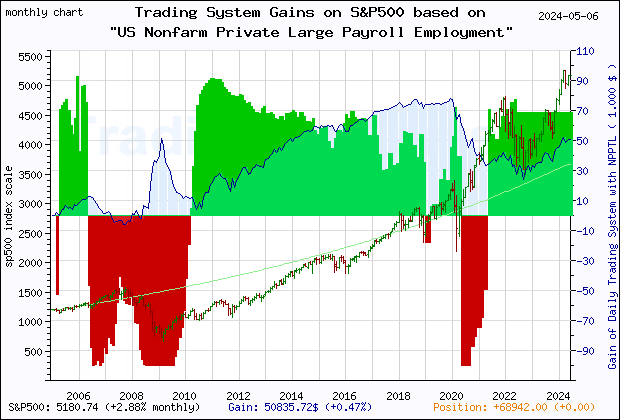

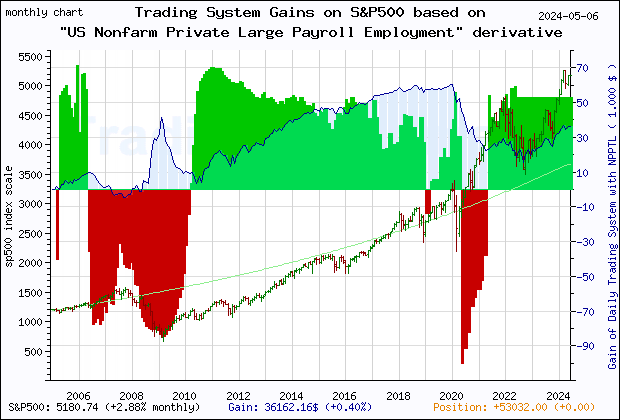

Free Trading System for S&P 500 based on: US Nonfarm Private Large Payroll Employment (> 499) (DISCONTINUED)

A lot of economic indicators are published at 8:30 AM, before the normal trading hours, that starts at 9:30. To simulate the results of the trading system in the past years we suppose the worst case scenario considering information and generating trading signals only at the end of the trading time, at 15:00.

This automatic system can be improved in the next future, using indicator data in intraday trading, to maximize the gain.

In this simulation the gain is calculated using a constant bound of the invested amount, from a short position of $ -100,000 to a long position of $ 100,000. This restriction is designed in order to compare results obtained in different time intervals.

In fact, investors usually take the full amount available to them. So if after a few years their amount is doubled from $ 100,000 to $ 200,000, a gain of 1% will double from $ 1,000 to $ 2,000. In our trading system instead, an increase of 1% will always correspond to a gain of no more than $ 1,000 because it will be invested no more then $ 100,000. Soon it will be available also the more realistic simulation that uses the full amount available.

In the space below are visible two or tree monthly diagrams considering a trading period from 20 years ago untill now. The second and the third simulate the results basing the trading signals on the economic indicator NPPTL and/or its derivative. The fisrt chart shows the main trading system that is a weighted sum of the other two.

For every graph there are represented:

- the S&P500 index, with open, max, min and close values recorded in the market for each month (green and dark red bars);

- the long or short position to trade the index throught a positive (light green area) or negative (red area) amount;

- the course of the gain achived (blue line with light blue area);

- a line of reference with 6% annual yield (green line), useful to compare charts with different axis scale.

On the left side of every diagram there is the axis of the S&P500 index value, while on the right there is the scale of the gain realized throught the trading system. The diagrams come daily dawned.

All data are showed reflecting the information when it was available, also postponed at 15:00, the closing time of the normal trading hours.

Last 20 years monthly quote chart of the S&P500 with the gain of the main trading system based on the economic indicator NPPTL and its derivative

Last 20 years monthly quote chart of the S&P500 with the gain of the main trading system based on the economic indicator NPPTL and its derivative

Last 20 years monthly quote chart of the gain obtained throught the trading system for S&P500 based on the derivative of the economic indicator NPPTL Last 20 years monthly quote chart of the gain obtained throught the trading system for S&P500 based on the derivative of the economic indicator NPPTL

|

Would you like to be available on the site other information? Demand them here .

We will try to realize the best ideas that will come to us proposed. |  |

|