Home

TradingSystems

Information, charts and tools for investors

|

|

|

IFI: Real Estate Funds Index

The TradingSystems.it publicate the IFI: Index of the Real Estate Italian Funds quoted in the MIV segment of the Italian Market. This is the only index daily updated available on Internet. It is an value weighted all share index type, that shows all the course of the real estate funds quotas, weighed based on their quotes capitalization.

The index is calculated starting from the 31/12/2001, with base value equal to 100.

All the real estate funds enter in the basket starting from the first day of quotation in the market, with reference value that one of their placement. In this way information about the firsts months of quotation the funds do not come eliminated, often in reduction regarding the placement date. It is obtained therefore the effective index of the value of real estate funds beginning from the value of purchase by the majority of the investors, that is exactly from the placement of the quotas.

The basket on which it comes calculated the index is become from the 5 real estate funds at the date of the 31/12/2001 to the 21 funds in today's date.

The index, like the stock quotations, diminishes of value in correspondence of detaches of the dividends or of the cash reimbursements. Thus in the diagrams there is also the course of the index added to the distributed proceeds, represented by a black line.

In the below space there are the historical weekly diagram updated from the beginning of the calculation and the daily index relative to the last year.

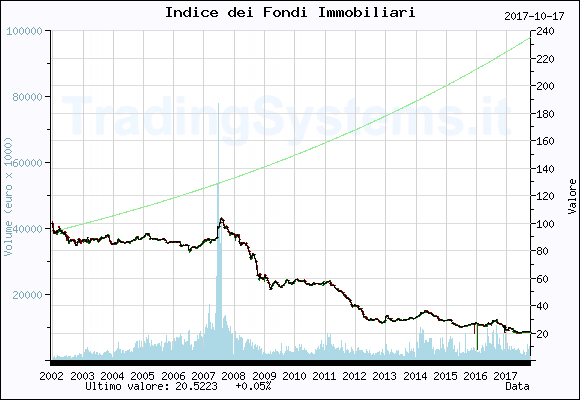

Weekly historical index diagram

Weekly historical index diagram

Daily index diagram of the last year

To the left of every diagram the scale of the exchanged total equivalent value in ag, expressed in thousands of euros is brought back, while to right that of the value dell' index. The diagrams come giornalmente dawned.

For every diagram the opening values are represented, maximum, minimum and closing of ag recorded for ciascuna week or day (bars greens and red dark), l' course of the values of closing added to the distributed proceeds (black line), that is l' total course (without reinvestimento of the proceeds) of an investment in deep the real estate ones and l' course of an index of reference with yield of annual 6% (light green line).

Daily index diagram of the last year

To the left of every diagram the scale of the exchanged total equivalent value in ag, expressed in thousands of euros is brought back, while to right that of the value dell' index. The diagrams come giornalmente dawned.

For every diagram the opening values are represented, maximum, minimum and closing of ag recorded for ciascuna week or day (bars greens and red dark), l' course of the values of closing added to the distributed proceeds (black line), that is l' total course (without reinvestimento of the proceeds) of an investment in deep the real estate ones and l' course of an index of reference with yield of annual 6% (light green line).

|

View/Hide all the mounthly values of the index: | Year | Month | Rounded close value | | 2001 | 12 | 100 | | 2002 | 1 | 94 | | 2002 | 2 | 92 | | 2002 | 3 | 94 | | 2002 | 4 | 93 | | 2002 | 5 | 93 | | 2002 | 6 | 89 | | 2002 | 7 | 87 | | 2002 | 8 | 87 | | 2002 | 9 | 87 | | 2002 | 10 | 86 | | 2002 | 11 | 87 | | 2002 | 12 | 87 | | 2003 | 1 | 87 | | 2003 | 2 | 90 | | 2003 | 3 | 87 | | 2003 | 4 | 89 | | 2003 | 5 | 88 | | 2003 | 6 | 88 | | 2003 | 7 | 88 | | 2003 | 8 | 89 | | 2003 | 9 | 90 | | 2003 | 10 | 91 | | 2003 | 11 | 87 | | 2003 | 12 | 85 | | 2004 | 1 | 86 | | 2004 | 2 | 87 | | 2004 | 3 | 86 | | 2004 | 4 | 86 | | 2004 | 5 | 86 | | 2004 | 6 | 86 | | 2004 | 7 | 87 | | 2004 | 8 | 88 | | 2004 | 9 | 89 | | 2004 | 10 | 89 | | 2004 | 11 | 89 | | 2004 | 12 | 89 | | 2005 | 1 | 91 | | 2005 | 2 | 91 | | 2005 | 3 | 89 | | 2005 | 4 | 88 | | 2005 | 5 | 88 | | 2005 | 6 | 87 | | 2005 | 7 | 88 | | 2005 | 8 | 88 | | 2005 | 9 | 87 | | 2005 | 10 | 86 | | 2005 | 11 | 86 | | 2005 | 12 | 87 | | 2006 | 1 | 87 | | 2006 | 2 | 86 | | 2006 | 3 | 83 | | 2006 | 4 | 84 | | 2006 | 5 | 84 | | 2006 | 6 | 84 | | 2006 | 7 | 81 | | 2006 | 8 | 82 | | 2006 | 9 | 82 | | 2006 | 10 | 83 | | 2006 | 11 | 84 | | 2006 | 12 | 86 | | 2007 | 1 | 88 | | 2007 | 2 | 88 | | 2007 | 3 | 87 | | 2007 | 4 | 88 | | 2007 | 5 | 89 | | 2007 | 6 | 96 | | 2007 | 7 | 104 | | 2007 | 8 | 98 | | 2007 | 9 | 97 | | 2007 | 10 | 93 | | 2007 | 11 | 93 | | 2007 | 12 | 93 | | 2008 | 1 | 90 | | 2008 | 2 | 90 | | 2008 | 3 | 85 | | 2008 | 4 | 85 | | 2008 | 5 | 85 | | 2008 | 6 | 80 | | 2008 | 7 | 75 | | 2008 | 8 | 77 | | 2008 | 9 | 70 | | 2008 | 10 | 59 | | 2008 | 11 | 60 | | 2008 | 12 | 60 | | 2009 | 1 | 60 | | 2009 | 2 | 56 | | 2009 | 3 | 53 | | 2009 | 4 | 57 | | 2009 | 5 | 57 | | 2009 | 6 | 55 | | 2009 | 7 | 54 | | 2009 | 8 | 55 | | 2009 | 9 | 58 | | 2009 | 10 | 57 | | 2009 | 11 | 56 | | 2009 | 12 | 57 | | 2010 | 1 | 59 | | 2010 | 2 | 58 | | 2010 | 3 | 58 | | 2010 | 4 | 58 | | 2010 | 5 | 55 | | 2010 | 6 | 56 | | 2010 | 7 | 55 | | 2010 | 8 | 56 | | 2010 | 9 | 56 | | 2010 | 10 | 56 | | 2010 | 11 | 56 | | 2010 | 12 | 56 | | 2011 | 1 | 57 | | 2011 | 2 | 58 | | 2011 | 3 | 55 | | 2011 | 4 | 54 | | 2011 | 5 | 52 | | 2011 | 6 | 51 | | 2011 | 7 | 50 | | 2011 | 8 | 48 | | 2011 | 9 | 46 | | 2011 | 10 | 44 | | 2011 | 11 | 39 | | 2011 | 12 | 40 | | 2012 | 1 | 40 | | 2012 | 2 | 38 | | 2012 | 3 | 36 | | 2012 | 4 | 32 | | 2012 | 5 | 30 | | 2012 | 6 | 29 | | 2012 | 7 | 29 | | 2012 | 8 | 30 | | 2012 | 9 | 30 | | 2012 | 10 | 28 | | 2012 | 11 | 28 | | 2012 | 12 | 28 | | 2013 | 1 | 32 | | 2013 | 2 | 30 | | 2013 | 3 | 29 | | 2013 | 4 | 29 | | 2013 | 5 | 30 | | 2013 | 6 | 30 | | 2013 | 7 | 29 | | 2013 | 8 | 30 | | 2013 | 9 | 30 | | 2013 | 10 | 31 | | 2013 | 11 | 31 | | 2013 | 12 | 31 | | 2014 | 1 | 32 | | 2014 | 2 | 33 | | 2014 | 3 | 34 | | 2014 | 4 | 36 | | 2014 | 5 | 35 | | 2014 | 6 | 34 | | 2014 | 7 | 33 | | 2014 | 8 | 32 | | 2014 | 9 | 31 | | 2014 | 10 | 30 | | 2014 | 11 | 29 | | 2014 | 12 | 29 | | 2015 | 1 | 30 | | 2015 | 2 | 29 | | 2015 | 3 | 27 | | 2015 | 4 | 26 | | 2015 | 5 | 25 | | 2015 | 6 | 24 | | 2015 | 7 | 25 | | 2015 | 8 | 25 | | 2015 | 9 | 26 | | 2015 | 10 | 26 | | 2015 | 11 | 27 | | 2015 | 12 | 27 | | 2016 | 1 | 26 | | 2016 | 2 | 26 | | 2016 | 3 | 25 | | 2016 | 4 | 26 | | 2016 | 5 | 26 | | 2016 | 6 | 26 | | 2016 | 7 | 29 | | 2016 | 8 | 29 | | 2016 | 9 | 27 | | 2016 | 10 | 26 | | 2016 | 11 | 25 | | 2016 | 12 | 22 | | 2017 | 1 | 24 | | 2017 | 2 | 23 | | 2017 | 3 | 21 | | 2017 | 4 | 21 | | 2017 | 5 | 20 | | 2017 | 6 | 20 | | 2017 | 7 | 21 | | 2017 | 8 | 21 | | 2017 | 9 | 21 | | 2017 | 10 | 21 |

|

|

Would you like to be available on the site other information? Demand them here .

We will try to realize the best ideas that will come to us proposed. |  |

|